The Problem

Across America, there are debates raging about what to do about the debt and they are usually between two camps: (a) the Obama camp of cut defense and raise taxes, particularly on the high income earners and (b) for lack of a better term, the Ryan camp, aimed at cutting most programs but most notably the various income transfer ones also known as entitlement programs also know as Social Security, Medicare, Medicaid, etc. The Fiscal Times has this piece by James Cooper:

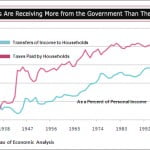

For the first time since the Great Depression, households are receiving more income from the government than they are paying the government in taxes. The combination of more cash from various programs, called transfer payments, and lower taxes has been a double-barreled boost to consumers’ buying power, while also blowing a hole in the deficit. The 1930s offer a cautionary tale: The only other time government income support exceeded taxes paid was from 1931 to 1936. That trend reversed in 1936, after a recovery was underway, and the economy fell back into a second leg of recession during 1937 and 1938.

As then, the pattern now reflects two factors: the severe depth of the 2007-09 recession and the massive fiscal policy response to it. The recession cut deeply into tax payments as more people lost their jobs, and it boosted payments for so-called automatic stabilizers, such as unemployment insurance, that ramp up payments as the economy turns down. Plus, policy actions, including the Recovery Act, boosted payments to households by expanding and extending jobless benefits and creating other income subsidies while extending the Bush-era tax cuts and adding new reductions in income and payroll taxes.

Government transfers of income to households started to overtake personal taxes at the start of 2008, and the gap has been widening. In February, households received more than $2.3 trillion in [annual] income support from unemployment benefits, Social Security, disability insurance, Medicare, Medicaid, veterans’ benefits, education assistance and other cash transfers of government funds to individuals. In the same month, households paid $2.2 trillion in [annual] income, payroll, and other taxes. The difference was about $150 billion [annually], equivalent to more than 1 percentage point of overall personal income and about four times the amount Republicans and Democrats agreed to cut from government spending through Sept. 30.

The article uses the following image to illustrate the issue (click to embiggen):

So one camp is arguing that the problem is the red line has declined. The other camp sees the blue line’s rise as the problem. Let’s be real clear: it’s the blue line.

GorT is an eight-foot-tall robot from the 51ˢᵗ Century who routinely time-travels to steal expensive technology from the future and return it to the past for retroinvention. The profits from this pay all the Gormogons’ bills, including subsidizing this website. Some of the products he has introduced from the future include oven mitts, the Guinness widget, Oxy-Clean, and Dr. Pepper. Due to his immense cybernetic brain, GorT is able to produce a post in 0.023 seconds and research it in even less time. Only ’Puter spends less time on research. GorT speaks entirely in zeros and ones, but occasionally throws in a ڭ to annoy the Volgi. He is a massive proponent of science, technology, and energy development, and enjoys nothing more than taking the Czar’s more interesting scientific theories, going into the past, publishing them as his own, and then returning to take credit for them. He is the only Gormogon who is capable of doing math. Possessed of incredible strength, he understands the awesome responsibility that follows and only uses it to hurt people.