Mailbag – Cabbages and Kings Edition

It wasn’t long before Dr. J. received a missive from none other than Operative RBK who returned from the other side of the mirror where he was on R&R from all things operative.

He writes in regarding Dr. J.’s recent anti-Krugman polemic:

Dr. J,

Just to point out, they are not really the same things, but they are very much related. To stay with the science and mathematics side of things: Debt (H – as on hole we are digging ourselves into) is like displacement, deficit (S – Spending money we don’t have) is like velocity and growth (G – Gee is it so hard to figure out) is like acceleration (that last one is a little bit shaky). So g= dD/dT (growth = change in debt/ change in time) and S = dH/dT (Deficit = change in Debt/ Change in Time)

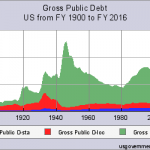

What Krugman seems to want to believe is that so long as inflation is higher than the increase in the deficit we can grow/ inflate our way out of debt because it is the deficit to GDP ratio Useful in visualizing the Debt to GDP ratio is the following chart:

Of note is the chart goes to 2016 and notice the sharp decline starting in 2013. Of course the numbers (non historical) projected by government offices are about as real as the tooth fairy (no offense to The Rock aka Dwayne Johnson).

From a family perspective this is the equivalent of an average family (2.6 people is seems according to my yandex-fu) has an income of $81,067 having a debt of $101,333 (and the US is not financing a home the way most families are today) So for your readers, take that 101,333 and add it to your mortgage to see what the US really looks like in terms of debt.

I suspect optimism and Hanlon’s Razor (Never attribute to malice that which is adequately explained by stupidity) moderate my response to Krugman a bit. I do not think that he really wants the government to provide for every facet of a person’s income and life.

Instead I think he just does’t think that he government doing so is a bad thing.

Of course one facet that many people tend to overlook is that the budget has to be passed by Congress. if you look at adjusted deficit spending by year with relation to the Political control you get this:

Year Nominal Dollars Inflation Adjusted President Senate House 2009 $1413 Billion Deficit -1539.22 Billion D D D 2010 $1294 Billion Deficit -1386.92 Billion D D D 2011 $1299 Billion Deficit -1350.31 Billion D D R 2012 $1100 Billion Deficit -1120.16 Billion D D R 1943 $54.6 Billion Deficit -737.84 Billion D D D 1944 $47.6 Billion Deficit -634.67 Billion D D D 1945 $47.6 Billion Deficit -618.18 Billion D D D 2004 $413 Billion Deficit -511.14 Billion R R R 2008 $459 Billion Deficit -498.37 Billion R D D 1983 $207.8 Billion Deficit -487.79 Billion R R D 1992 $290.4 Billion Deficit -484 Billion R D D 2003 $377.6 Billion Deficit -479.8 Billion R R R 1986 $221.2 Billion Deficit -471.64 Billion R R D 1991 $269.3 Billion Deficit -461.92 Billion R D D 1985 $212.3 Billion Deficit -461.52 Billion R R D 1984 $185.4 Billion Deficit -417.57 Billion R R D 1993 $255.1 Billion Deficit -412.78 Billion D D D 1990 $221.2 Billion Deficit -395.71 Billion R D D 2005 $318 Billion Deficit -380.84 Billion R R R 1994 $203.2 Billion Deficit -320.5 Billion D D D 1982 $128 Billion Deficit -309.93 Billion R R D 1987 $149.7 Billion Deficit -308.02 Billion R D D 1988 $155.2 Billion Deficit -306.72 Billion R D D 1976 $73.7 Billion Deficit -303.29 Billion R D D 1942 $20.5 Billion Deficit -292.86 Billion D D D 1989 $152.5 Billion Deficit -287.74 Billion R D D 2006 $248 Billion Deficit -287.7 Billion R R R 1995 $164 Billion Deficit -251.53 Billion D R R 1975 $53.2 Billion Deficit -231.3 Billion R D D 1978 $59.2 Billion Deficit -212.19 Billion D D D 1980 $73.8 Billion Deficit -209.66 Billion D D D 1977 $53.7 Billion Deficit -207.34 Billion D D D 2002 $157.8 Billion Deficit -205.2 Billion R D R 1981 $79 Billion Deficit -203.08 Billion R R D 1946 $15.9 Billion Deficit -191.57 Billion D D D 2007 $161 Billion Deficit -181.51 Billion R D D 1968 $25.2 Billion Deficit -169.13 Billion D D D 1996 $107.5 Billion Deficit -160.21 Billion D R R 1971 $23 Billion Deficit -132.95 Billion R D D 1979 $40.7 Billion Deficit -130.87 Billion D D D 1972 $23.4 Billion Deficit -130.73 Billion R D D 1959 $12.8 Billion Deficit -103.23 Billion R D D 1973 $14.9 Billion Deficit -78.42 Billion R D D 1941 $4.9 Billion Deficit -77.78 Billion D D D 1967 $8.6 Billion Deficit -60.14 Billion D D D 1953 $6.5 Billion Deficit -57.02 Billion R R D 1962 $7.1 Billion Deficit -55.04 Billion D D D 1940 $2.9 Billion Deficit -48.33 Billion D D D 1964 $5.9 Billion Deficit -44.36 Billion D D D 1963 $4.8 Billion Deficit -36.64 Billion D D D 1997 $22 Billion Deficit -32.07 Billion D R R 1950 $3.1 Billion Deficit -30.1 Billion D D D 1974 $6.1 Billion Deficit -28.91 Billion R D D 1966 $3.7 Billion Deficit -26.62 Billion D D D 1955 $3 Billion Deficit -26.09 Billion R D D 1961 $3.3 Billion Deficit -25.78 Billion D D D 1958 $2.8 Billion Deficit -22.58 Billion R D D 1970 $2.8 Billion Deficit -16.87 Billion R D D 1952 $1.5 Billion Deficit -13.27 Billion D D D 1954 $1.2 Billion Deficit -10.43 Billion R R D 1965 $1.4 Billion Deficit -10.37 Billion D D D 1960 $0.3 Billion Surplus 2.36 Billion R D D 1949 $0.6 Billion Surplus 5.88 Billion D D D 1969 $3.2 Billion Surplus 20.38 Billion R D D 1957 $3.4 Billion Surplus 28.33 Billion R D D 1956 $3.9 Billion Surplus 33.62 Billion R D D 1947 $4 Billion Surplus 42.11 Billion D R R 1951 $6.1 Billion Surplus 54.95 Billion D D D 1998 $69.2 Billion Surplus 99.28 Billion D R R 1948 $11.8 Billion Surplus 114.56 Billion D R R 2001 $127.3 Billion Surplus 168.16 Billion R D R 1999 $125.6 Billion Surplus 176.16 Billion D R R 2000 $236.4 Billion Surplus 320.76 Billion D R R

At this point, ‘Puter staggered through the Castle library and tripped over the server cable, and the message was disrupted.

Dr. J. emailed RBK back for the conclusion to which he responded:

Dr. J.

I am going to try but right now I cannot get it to come out like I would like, you know how it is when you have something worded the way you wanted. It’s hard to reproduce.

[REDACTED FOR OPERATIONAL SECURITY REASONS]

I mentioned Monetary velocity and the it is velocity * GDP * tax rate that reflects the tax income and so by increasing the velocity we increase the tax revenue. I also said that tax revenue must increase and spending must decrease or stay flat with proceeds equalling outgo at a minimum just to stop the debt from increasing.

I also know I had Krugman’s quote from the NYT about the government not having to pay back debt unlike a family and information showing that the federal government actually has to pay it back much more quickly because of the length a thill and other borrowing methods actually last.

It may be best for you to simply disregard my message on this subject altogether and move forward with whatever your response to others would be. Sorry for taking your time.

Dear RBK,

While Dr. J.’s primary point was that Joe Sixpack may not know the difference between the deficit and debt, but that doesn’t mean he doesn’t know or believe that the government is overspending. What Dr. J. resents is when Washington continues to overspend and they talk about a shrinking deficit. While they’re technically telling the truth, they are deliberately misleading the public. Lies, damned lies and statistics, right?

This is how his congressman, Jim Cooper pretends to be a deficit hawk. “Gee Willikers, guys, we’re shrinking that big bad deficit, I tell ya! That’s something them Republicans never did!” Mr. Cooper, a really nice man, has nibbled around the edges of other politicians pork, but he’s never tackled the problem.

To your point, you are correct. First and foremost when you talk about monetary velocity, you are absolutely spot on. The more rapidly money moves around (to oversimplify your point) the bigger the GDP grows. Right now the tortoise moves faster than our economy.

Krugman and even some on the right have subscribed to the view that we can grow our way out of our debt. And a small amount of debt is tolerable, and sometimes desirable. The leftist trope regarding how the federal budget isn’t the family budget always makes Dr. J. laugh because Dr. J.’d go to jail if he printed his own money, and he can’t sell J. Bonds with as much flair, or with a level of security as offered by the federal government (because they can print more money), but they should behave like the rest of us do, by and large with deficit spending for emergencies and not everyday life.

This is how Republicans justified the deficit spending of the 80s. Then, though, we were more realistically justified in that we were playing economic siege warfare with the Soviets and trying to get their economy to collapse before ours did. Then deficit spending was a matter of national security. Now deficit spending is simply re-election campaigning.

Even worse, we aren’t growing our way out of a paper bag in the near future, so even if Krugman’s hypothesis was plausible, that strategy will work extremely slowly.

What we need to do is, as Dr. J. has said in the past, is hit the undo button on the Obama years, reasonably re-deregulate the energy, insurance and medical sectors of the economy, fix the tax code, address spending and watch the economy take off, but that will never happen because the government can’t buy the votes of a prosperous people…only dependents.

Thanks for writing in twice!